In the rapidly evolving world of cryptocurrencies, Australia has steadily emerged as a noteworthy player, particularly in the niche yet promising realm of Monero mining investments. Unlike Bitcoin or Ethereum, Monero offers a different paradigm—privacy-centered blockchain technology, putting it at the forefront for users who prioritize anonymity in their transactions. This unique proposition has attracted a wave of Australian investors and enthusiasts eager to capitalize on mining opportunities. The process, however, is far from straightforward; it involves a meticulous balance between acquiring cutting-edge mining machines and securing efficient hosting solutions to optimize profitability in an increasingly competitive market.

Monero mining rigs differ significantly from those crafted for mainstream cryptocurrencies like Bitcoin (BTC) or Ethereum (ETH). Given Monero’s reliance on RandomX, an algorithm designed to be ASIC-resistant, miners typically turn to high-performance CPUs rather than specialized, expensive ASIC hardware commonly found in BTC mining farms. Australian enthusiasts have been quick to adapt, leveraging multi-core processors and custom-configured GPUs that optimize hashing power without inflating energy costs. The emphasis on privacy and decentralization aligns well with the ethos embraced by many in Australia’s tech community, sparking a surge in mining rig sales and hosted mining services tailored specifically for Monero.

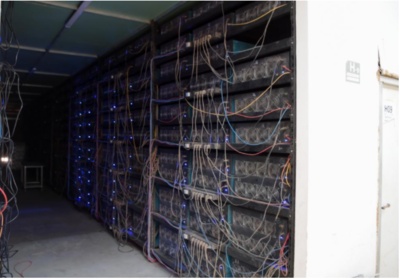

Hosting, in this context, is integral: it’s one thing to own a top-tier rig, but quite another to ensure it operates within an environment that maximizes uptime and minimizes heat and electricity expenses. Australia’s geographical vastness offers a distinct advantage here—locating mining operations in cooler regions or areas with access to renewable energy sources like hydro and solar dramatically reduces operational costs. Hosting providers that specialize in Monero mining often provide bespoke solutions, combining secure colocation spaces with high-speed connectivity and real-time monitoring, enabling investors to participate fully without grappling with the complexities of daily hardware management. This symbiotic relationship has galvanized a new type of crypto entrepreneur: the partial or full-time mining machine host.

Another fascinating dynamic at play is the duality between Monero’s privacy-focused nature and its market liquidity across various crypto exchanges. While BTC and ETH boast broad acceptance, Monero’s trade volumes, especially on Australian exchanges, remain modest but strategically growing. Consequently, investors are not only interested in mining but also in trading Monero, leveraging price swings across local and global platforms. Some savvy miners utilize hosted rigs to mine Monero coins and maintain active positions on exchanges, blending operational income with short-term market gains. This hybrid approach reflects an increasing sophistication in how Australian participants engage with both the technological and financial facets of crypto mining.

The Australian government’s stance has also influenced this trajectory. Regulatory clarity around cryptocurrency mining and hosting—particularly guidelines on energy consumption and taxation—has emboldened institutional players. Moreover, environmental consciousness has catalyzed partnerships between miners and renewable energy providers, ushering in a new era where mining aligns with sustainability goals. Such collaborations can be seen most vividly within large-scale mining farms dispersed across regions like New South Wales and Victoria, where renewable infrastructure supports sprawling rig installations.

Interestingly, the Monero mining wave complements other cryptocurrency endeavors within Australia, including those centered on Bitcoin and Ethereum. While BTC miners depend heavily on ASIC rigs—manufactured to push hashing power to extremes—Monero miners hone their expertise on CPU-based mining farms optimized for the RandomX algorithm. Ethereum miners, now transitioning to proof-of-stake mechanisms, have further diversified the ecosystem, prompting many to shift focus towards privacy coins like Monero, which remain proof-of-work. The interplay among these currencies and their respective mining demands fosters a richly varied marketplace for mining hardware, hosting services, and even aftermarket maintenance businesses dedicated to enhancing rig efficiency and longevity.

Australian miners and investors also benefit from a rapidly expanding community of developers and innovators constantly refining mining software and blockchain protocols to enhance Monero’s efficiency and security. Open-source initiatives encourage collaboration, spawning tools for better rig management and performance analytics, furthering the appeal for professional mining hosts. This spirit of innovation extends beyond hardware and software—into finance—where emerging decentralized finance (DeFi) platforms in Australia contemplate integrating Monero-based liquidity pools, promising additional avenues for profit and versatility for crypto stakeholders.

Ultimately, Australia’s trailblazing journey in Monero mining investments reflects a broader narrative—one of transformation and adaptation. From the conception of mining theory to the full realization of vast hosting farms peppered across the continent, Australians have crafted a unique legacy within an ultra-competitive global landscape. This journey epitomizes the confluence of cutting-edge technology, sustainable operational practices, and savvy financial strategies. As privacy concerns grow worldwide and blockchain technology continues to mature, Australia’s Monero mining infrastructure stands poised to be a benchmark for innovation, profitability, and resilience.